Constant Campaign: Retail Engagement in Sunny Days

A quiet revolution is unfolding in the worlds of proxy voting, corporate governance and investor communications. So-called ‘pass-through’ voting programs, rolled out by large asset managers, are bringing millions of new participants into the proxy-voting ecosystem and creating entirely new cohorts of retail shareholders at publicly listed companies.

On October 21, Vanguard made a major announcement in this process with the addition of three funds – including its flagship S&P 500 ETF (VOO), the world’s largest ETF – to the list of participating funds in its pass-through voting program next year (which it calls Investor Choice). With this expansion, 20 million of Vanguard’s 50 million clients will be eligible to participate in its pass-through voting program in the 2026 season.

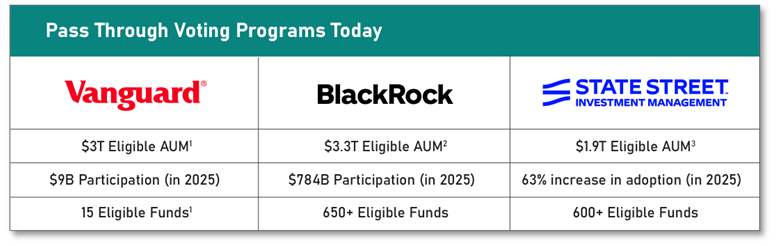

Few would have predicted such rapid growth in pass-through when the ‘Big Three’ asset managers – Blackrock, Vanguard and State Street – put the programs in place a couple of years ago. Since then, each of the programs has been refined and evolved to encompass ever-greater AUM eligibility and grown in participation. Today, Vanguard’s $3T Investor Choice is the largest pass-through program focused on individual investors. Blackrock’s pass-through program has $3.3T in eligible assets, including the iShares Core S&P 500 ETF with its more than 3 million investors. Meanwhile, more than 80% of State Street’s eligible index equity assets are available in its $1.9T program, which includes 600 institutional index funds and SPDR ETFs across the U.S., U.K. and Europe.

The big asset managers have made it clear: expansion of pass-through is not done yet. When announcing Vanguard’s expansion, Global Head of Investment Stewardship John Galloway reiterated his firm is “committed to building on our legacy of accessibility by continuing to expand Investor Choice to all our U.S. equity index funds.” As more funds are added, and marketing machines are put to work, pass-through programs are likely to gain more momentum and continue to grow in participation.

Shareholder engagement professionals should take note of this new reality. The center of power is shifting and an ever-growing share of votes at major companies will be either directed via pass-through or voted by retail. Companies need to evolve their approaches. In a time of fragmented shareholder registers, every vote matters that much more.

Constant Campaign: Retail Engagement in Sunny Days

Engagement with retail – for years a feature only of contested fights – needs to become a central element of the evolving world of shareholder communications. Pass-through voting is part of a larger set of changes that includes the SEC’s No-Action on Exxon’s Retail Voting Program and the bifurcation of stewardship functions at the big three. For corporate issuers with a significant retail base, it is critical to better understand who owns their shares and how to reach them. The time for companies to start this process is now.

Here are some best practices and considerations as companies evolve these plans.

a) INVEST IN RETAIL PROGRAMS FOR THE LONG TERM: An ongoing dedicated retail program and communications cadence will pay dividends in the future. Companies such as Pfizer and Disney have established retail shareholder programs that maintain constant engagement and produce focused content on an ongoing basis. Deploying this information helps companies build robust outreach strategies during sunny days which could be put to work at times of need.

b) GET TO KNOW YOUR RETAIL BASE: Companies can start by building a better understanding of their retail base and who owns the shares. Proxy solicitors can help gather key intelligence, understand certain attributes, and help map out shareholder bases (i.e., hometown companies, companies with large sets of retirees or insider holdings, even visitor logs to company IR or LinkedIn sites help build a picture).

c) ACCESSIBLE MATERIALS IN ACCESSIBLE PLACES: For a while now, companies have known to move beyond press releases and investor presentations to communicate key moments. If not in place yet, companies should build these core storytelling capabilities by developing factsheets, newsletters and videos, and establishing a presence where retail holders go for information. Walmart, for example, is among the many companies posting earnings calls on YouTube (800k+ followers), and dedicated earnings videos on LinkedIn (4M+ followers).

d) ACCESSIBLE MANAGEMENT TEAMS: Other companies, including Coinbase and Tilray, are going a step further and giving shareholders a voice by allowing retail investors to directly ask management questions using a third-party platform. Reddit uses its own platform to canvas questions from investors and post social-friendly videos of its results.

e) RETAIL-FOCUSED WEBSITES: It is now standard to use ‘fight sites’ in major shareholder activism situations – but companies should think of websites as a year-round resource. Tesla’s website votetesla.com is a centerpiece of its solicitation process ahead of its November 6, 2025, Annual Meeting. Among other features, Tesla’s site includes very simple ‘how-to-vote’ explainers for retail holders split by a broker by broker basis. Such assets should not be used only around key votes: consider Robinhood, which put together its 2025 annual meeting materials, key issues and voting instructions, in an easy-to-use retail website.

f) VIDEO KILLED THE RADIO STAR: Video is now a central feature of corporate storytelling and shareholder engagement. A recent memorable example is Professor Ludwig Von Drake giving a how-to-vote guide to Disney shareholders during Disney’s successful proxy defense against Trian Partners. Video is also very commonly used at earnings and reaches broad audiences beyond retail holders, whether it is with pithy animations, such as Match Group’s earnings summary, or with direct-to-camera videos like those by Blackstone’s Jon Gray and Shopify’s Harley Finkelstein.

g) MULTI-PLATFORM ADVERTISING FOCUS: Companies involved in special situations and proxy fights are growing adept at using multi-platform methods to reach shareholders – these tactics, often very cost effective from an ROI perspective, include Google Ads, display advertising on news sites and social media, SEO and even audio advertisements in well listened-to podcasts.

h) UNDERSTAND HOW PASS-THROUGH AFFECTS YOU: Not all pass-through voting programs are created equal, and their expansion will affect shareholder registers unevenly. Companies should stay abreast of the latest developments, take time to understand the menus and additions to the programs and understand voting patterns and records as these programs evolve. Here is Vanguard’s latest comprehensive report on Investor Choice, including overall shareholder preferences on a fund-by-fund basis.

Pass-Through Voting Mechanics: A Quick Refresher

Pass-through voting allows clients of large asset managers to direct how their shareholdings are proportionately voted at shareholder meetings of participating companies.

Although institutional clients of large asset managers have been able to vote their proxies for several years, in 2022 and 2023 Blackrock, Vanguard and State Street announced and launched ‘pass-through’ programs with broader audiences in sight.

Today, a broad swath of investors – from individual investors to financial advisors, plan sponsors and institutional clients – can participate in the different programs.

The term pass-through is a slight misnomer as participating investors don’t yet vote on individual proxies. Instead, proxy voting power passes through by allowing investors to direct how their fund holdings are voted at company shareholder meetings. Participants choose from menus which include options such as Glass Lewis or ISS-designed policies, company board-aligned, in-house policies, and so-called mirror voting.

The details and menu options of each program vary, but they all have one clear common thread: in-house stewardship is no longer the automatic choice for all proxy votes – it is instead a service, an option among many.

The View from Practitioners and Academics – Five Takeaways

In early September, the corporate governance ecosystem including issuers, investors, advisors, academics and technology companies gathered at the Nasdaq MarketSite for the first-ever conference on pass-through voting, sponsored by Vanguard, Nasdaq and the NYU Institute for Corporate Governance and Finance. Here are some important takeaways leading practitioners brought from the event.

1. These programs are evolving – their architecture and design is not set in stone

“As we continue to build our Investor Choice program, we are exploring how do we work within the existing system and what innovation can we drive, who can we work with to make it a more seamless experience across the ecosystem,” said John Galloway, Global Head of Investment Stewardship at Vanguard.

2. Expansion is likely to impact close votes…

Columbia Law School’s Dorothy Lund is one of the leading academics studying pass-through voting. She noted that the result of an expansion of pass-through voting programs could have meaningful impacts in contentious proxy votes. A new paper she co-authored on the topic found that “the expansion of voting choice could increase the likelihood of proposal failure. More specifically…had Vanguard’s voting choice program applied to all indexed assets in 2024, two dissident proposals would have flipped from passing to failing, due to the popularity of pro-management voting policies in the pilot program.”

3. Expansion may also have an impact on M&A and other corporate issues…

Sullivan & Cromwell’s Melissa Sawyer said, “While it is still early to see an impact in outcomes, it will be very interesting to see uptake data as these programs grow, as that may play into how we analyze situations. In some cases, for example, we could see more M&A transactions structured as tender offers rather than traditional mergers in light of these developments.![]()

4. The time for corporates to start planning is now

Jane Edwards, Vice President, Assistant General Counsel and Corporate Secretary at IBM, noted the uncertainty it could bring if issuers do not know who their shareholders are and how to reach them if there are close proxy contests. “With these developments, the onus is now on much better planning on the part of corporates and their advisors, so they can reach all investors effectively if they know they face a close vote.”

5. Menu design is a central issue, and will continue to be for some time

Elina Tetelbaum of Wachtell Lipton cautioned that the way these programs are presented and communicated to individual investors is likely to have a meaningful impact on reception, uptake and even choices made by participants: “Menu design and even the language used to describe these programs and the menu available to investors should be looked at carefully and will be a critical aspect going forward.”

John Croke of Vanguard outlined some of the considerations that were made in designing the menu voting policies participating investors are given, saying “You can have a few choices that individuals understand and can choose from, or lots of choices that make it hard for people to decide. That’s the fundamental trade-off.”

1For upcoming 2026 season. (go back)

2https://www.blackrock.com/corporate/about-us/investment-stewardship/blackrock-voting-choice(go back)

3https://investors.statestreet.com/investor-news-events/press-releases/news-details/2025/State-Street-Global-Advisors-Sees-Strong-and-Growing-Market-Adoption-of-Proxy-Voting-Choice-in-Q1-2025/default.aspx (go back)

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.